What Gives the Us Government the Power to Collect Taxes

Although states receive funds directly from the federal government these funds alone are insufficient for the states to operate which is why they must collect taxes. From taxes and other non-tax sources.

Where Does The Us Government Get Its Money Committee For Economic Development Of The Conference Board

Each state had the responsibility to manage its own trade agreements.

. Because the Articles of Confederation disallowed the central Government to enforce the collection of taxes it found itself in a financial crisis. Unemployment and labor programs like Temporary Assistance for Needy Families TANF as well as retirement and disability benefits for federal employees. The Congress shall have Power to lay and collect Taxes Duties Imposts and Excises to pay the Debts and provide for the common Defence and general Welfare of the United States.

How does the government tax citizens. Government expenses like US. Check all that apply.

Here are a few other ways the government uses your tax money. The 16th Amendment to the United States Constitution gives Congress the power to collect a federal income tax from all individuals and businesses without sharing or apportioning it among the states or basing the collection on the US. The income received by a gov.

So the Founding Fathers wrote the Constitution to give the Central government the power to collect taxes. But all Duties Imposts and Excises shall be uniform throughout the United States. Not only does Congress have broad powers to levy taxes but the Supreme Court has allowed the government to acquire several fringe benefits by regulating some of the subject matter selected for taxation.

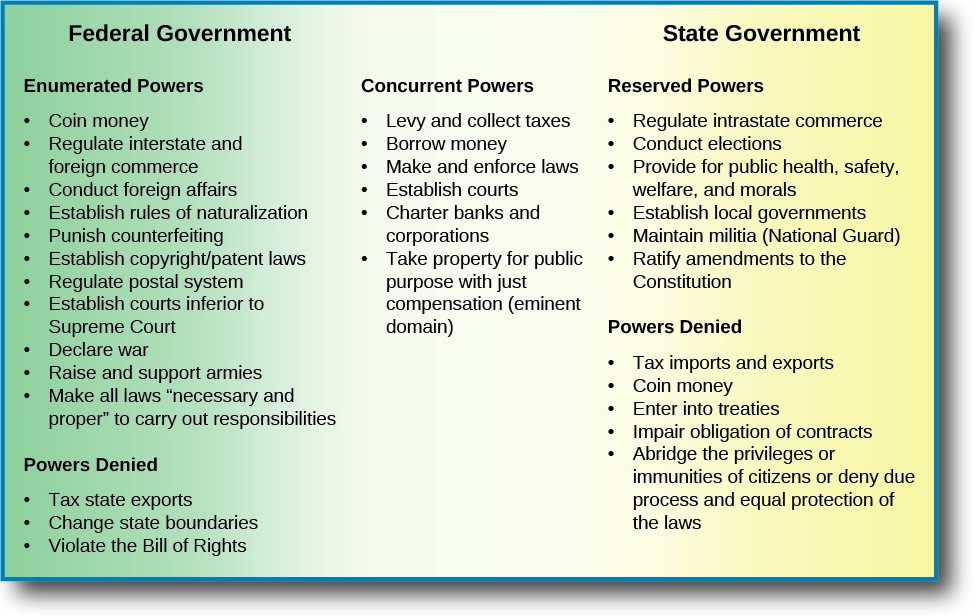

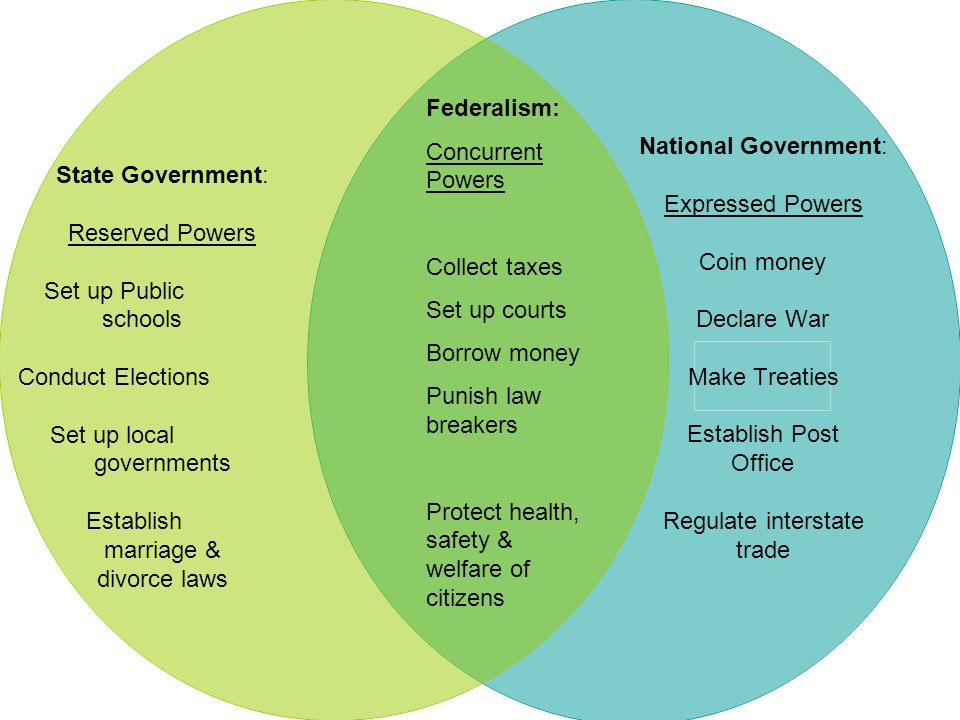

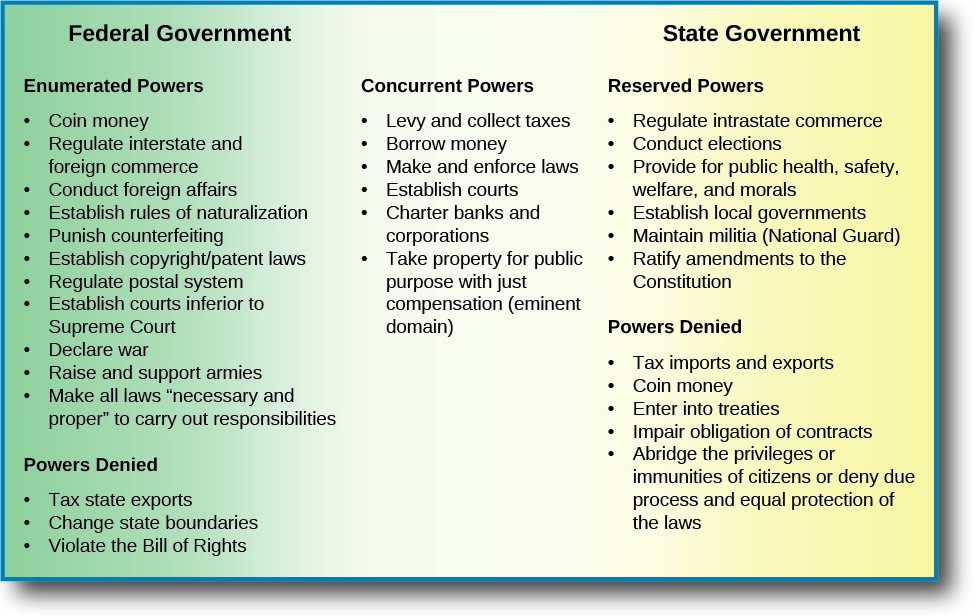

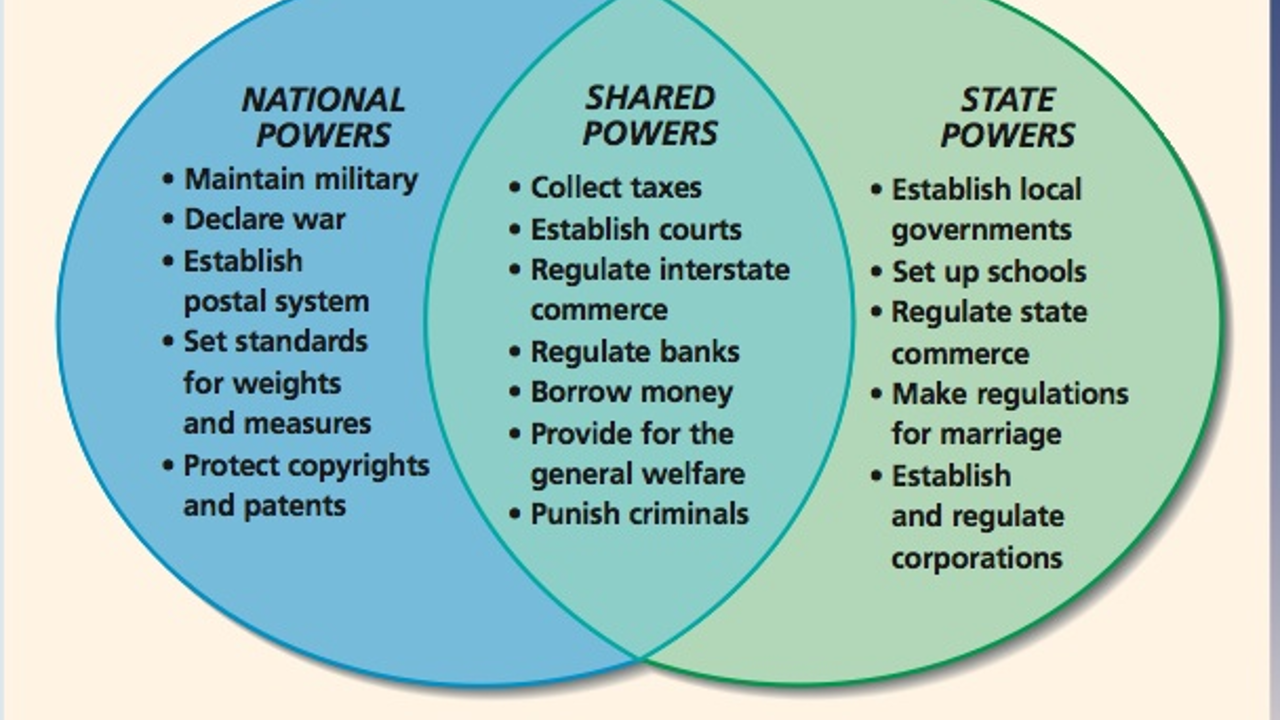

Gives the US Government the power to collect taxes. This is also referred to. The powers not delegated to the United States by the Constitution nor prohibited by it to the States.

Each state in the nation has the authority to impose its own taxes to support state government programs. The Constitution Laws passed by Congress An executive order Common law. Which of these best describes income tax.

Taxes are imposed on. What does the gov operate with the collected taxes. Answer 1 of 4.

Taxesmore precisely the money they providemake all other government actions possible. The Supreme Court has used the authority of the Sixteenth Amendment to give unlimited power to Congress to tax and regulate the people for any reason and in nearly everything. One might think about that in relation to present-day loose confederations such as the United Nations NATO and the European Union.

When the Articles of Confederation was extensively amended it still has applicable law the writers of the new US Constitution in order to make a more perfect Union decided after a lot of thought to define the purpose of. This is also referred to as the Taxing and Spending Clause Income Taxes. The Constitution laws passed by Congress an executive order common law Which are examples of programs or projects most likely funded by taxes in the United States.

Amendment 16 states congress has the power to lay and collect taxes. List 4 ways in which the gov power to tax is limited by the constitution. Power to Tax and Spend.

Laws passed by Congress C. The Congress shall have Power to lay and collect Taxes Duties Imposts and Excises to pay the Debts and provide for the common Defence and general Welfare of the United States. An executive order D.

National defense highways education law enforcement and people in need. The Constitution gave Congress the power to lay taxes and also to collect them. Congress could not negotiate trade with foreign nations.

Before the Constitution the Articles of Confederation existed and therefore the Central Government could not collect taxes thus not being able to pay foreign loans or their soldiers. What gives the US government the power to collect taxes. O an executive order.

Article I Section 8 gives Congress the power to lay and collect taxes duties imports and excises The Constitution allows Congress to tax in order to provide for the common defense and general welfare The Court has flip-flopped on the issue of whether Congress has the constitutional power to tax in. What gives the US government the power to collect. Regressive tax progressive tax direct tax proportional tax What gives the US government the power to collect taxes.

The right to create a uniform currency was delegated to the federal government. What amendment gives the government power to collect taxes. 4518 What gives the US government the power to collect taxes.

Power to Tax and Spend. It is the Sixteenth Amendment to the United States Constitution that gives the government the power to. Government the right to collect taxes.

In the United States Article I Section 8 of the Constitution gives Congress the power to lay and collect taxes duties imposts and excises to pay the debts and provide for the common defense and general welfare of the United States. Common law The constitution gives the US. Mark this and return.

The state of Colorado for example needs to collect taxes to house. O laws passed by Congress. Customs and Border Protection and the operation of the Federal Prison System.

What gives the US government the power to collect taxes. But all Duties Imposts and Excises shall be uniform throughout the United States. Which amendment gives government power to impose income tax.

Is the power to collect taxes a reserved power. The central Government had soon discovered that it was unable to not only manage the few allowances of power that it was granted by the Articles of Confederation but also unable to maintain them without proper funding. In the United States Article I Section 8 of the Constitution gives Congress the power to lay and collect taxes duties imposts and excises to pay the debts and provide for the common defense and general welfare of the United States.

Article I Section 8 gives Congress the power to lay and collect taxes duties imports and excises The Constitution allows Congress to tax in order to provide for the common defense and general welfare. Congress was given the power to levy and collect taxes for the federal government. In the United States Article I Section 8 of the Constitution gives Congress the power to lay and collect taxes duties imposts and excises to pay the debts and provide for the common defense and general welfare of the United States.

State Government Reserved Powers Set Up Public Schools Conduct Elections Set Up Local Governments Establish Marriage Divorce Laws National Government Ppt Download

Interpretation The Taxing Clause The National Constitution Center

The Irs Didn T Appear On The Scene Until 1862 That S When The Federal Government Began To Wooden Pallets For Sale Wood Crates For Sale Wood Pallets For Sale

It Is Time To Repeal The 10th Amendment And Unify America 10 Amendments Constitutional Amendments Bill Of Rights

A Taxing Time Newspaper In Education

Federalism Poster Zazzle Com Social Studies Education Social Studies Education Poster

Where Does The Us Government Get Its Money Committee For Economic Development Of The Conference Board

A Brief History Of Income Taxes Teaching History History Facts History Teachers

5th Grade Anchor Charts To Try In Your Classroom 4th Grade Social Studies Teaching Economics Personal Financial Literacy

Government Chapter 3 Federalism Flashcards Quizlet

Article What Are Some Common Tax Myths Link Inside Gain Followers Argument Irs

The Division Of Powers American Government

Pin On American History Interactive Notebook Resources

Where Does The Us Government Get Its Money Committee For Economic Development Of The Conference Board

Comments

Post a Comment